Rare Metals Recovery Project

In Partnership with:

Background

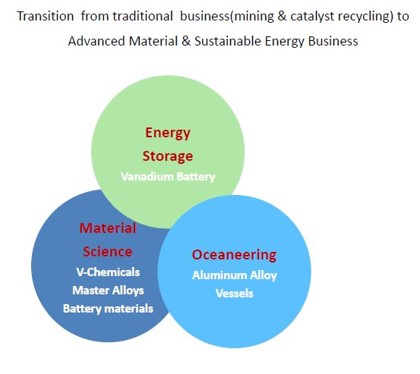

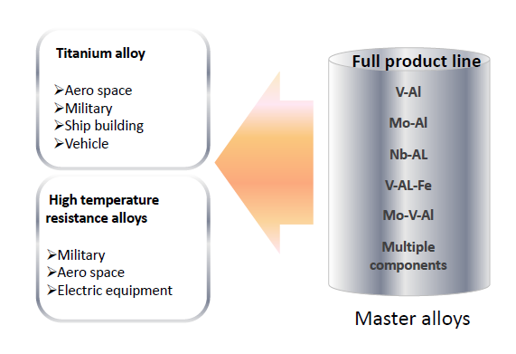

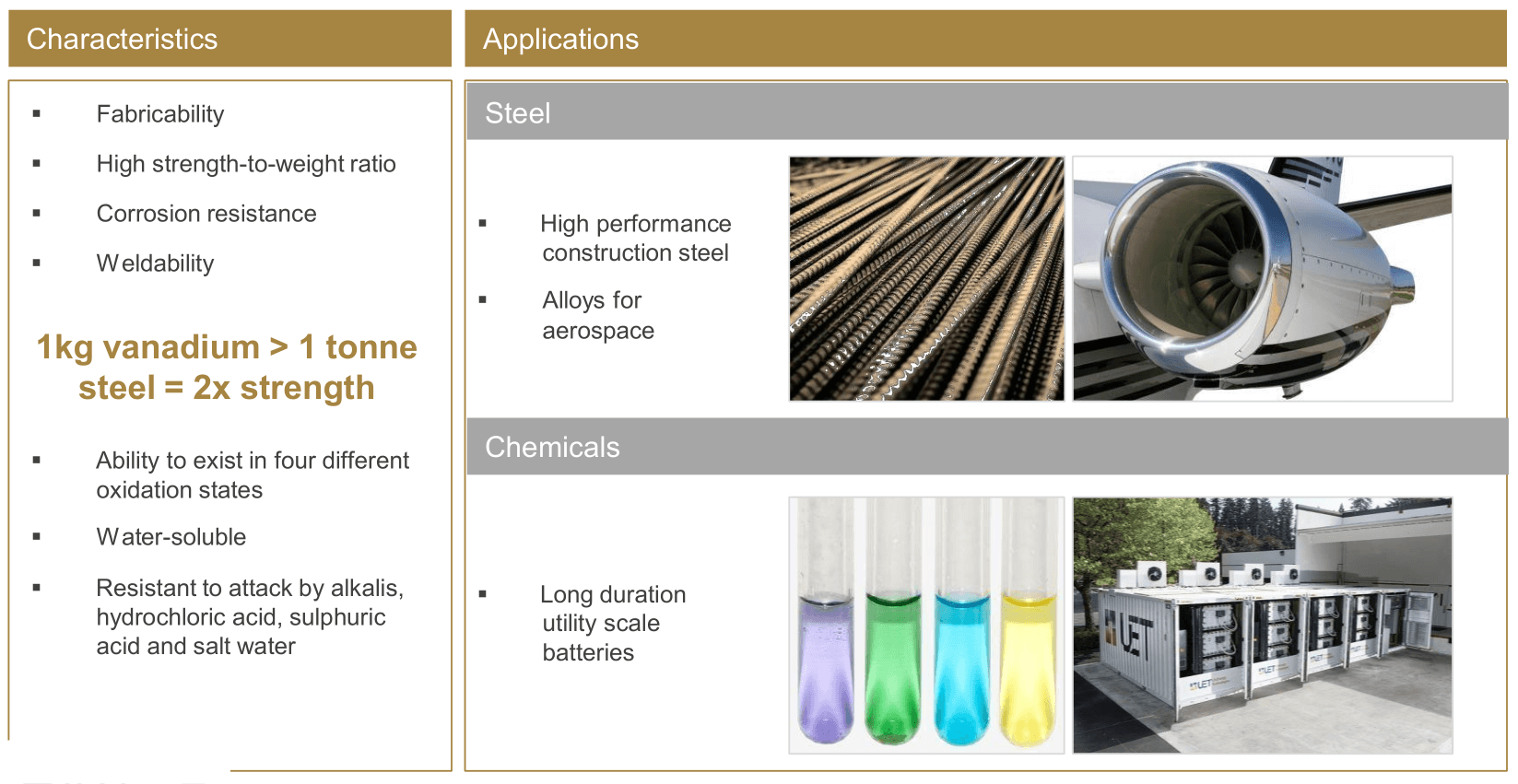

BOLONG Holding Group is a privately-owned, international company headquartered in Dalian, China, with leading businesses in energy storage, natural resources, advanced materials & chemicals, and capital investment. The Group has constructed ten refineries processing feedstock from oil fired power stations oil refineries since its inception in the early 2000’s. This experience has placed it as the technical leader in the design and construction of vanadium refineries processing feedstock from the aforementioned sources. The technology applied in any given refinery is dependent on the feedstock, this knowhow is supported by approximately 300 research and technical vanadium experts located at the Group’s BNH Special Materials Ltd facilities which are located in the Huayuankou economic zone in Dalian. As a result of its leadership position in vanadium refining, the Group is the largest producer of chemical grade vanadium products for use in the production of master alloys and super alloys and similar metals used in the highly exacting aviation and aerospace industries and catalysts for the oil refining and similar industries. In further support of the Group’s leading position in vanadium, the Group through its majority owned subsidiary Dalian Rongke Power Co. Ltd, is the largest producer of vanadium redox batteries including its US subsidiary UniEnergy Technologies.

Seabourn Company provides the full suite of investment banking services with an emphasis on the agribusiness, industrial, metals and minerals in related sectors.

RIWAQ has successfully signed an agreement to partner with Bolong Holding Group and Seabourn Company to establish a JV company to develop a low cost rare metals refining project using Saudi Arabia heavy Crude oil Fly Ash, Oil Residue and catalyst as Feedstock.

Opportunity Overview

Our partners bring together a very specialized skill set in this field to promote and increase use of clean renewable energy and efficient use and conservation of natural resources.

Rare Metals demand is expected to increase as it is used in structural steel, Aerospace alloys and mass storage redox batteries.

Refining of feedstock to remove rare metals will reduce or remove entirely the environment hazards associated with rare metals in the feedstock.

Preliminary financial analysis presents a very compelling business case.

Project Status

- The Project is under development by securing the feed stock from local refineries and power plants.

- RIWAQ has completed an offtake agreement for 100% of produced metals.

- Expected project execution by 2021.